affordable care act exemptions smart card For example, a 55-year-old couple in Chicago who earns $80,000 in 2025 would . Issues 5 - ID Card and E-Passport Reader NFC Android Application - Sample .

0 · no health insurance exemptions

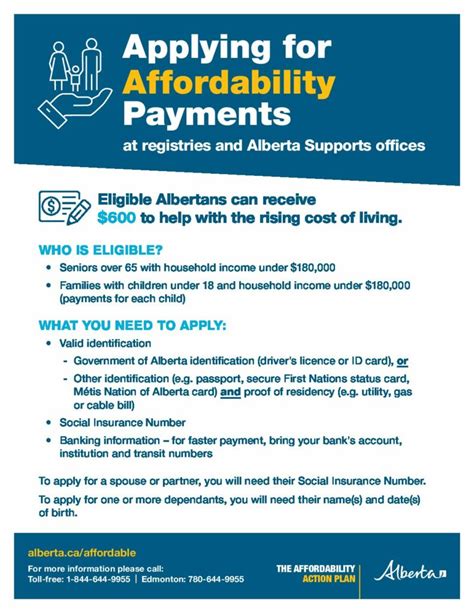

1 · how to apply for affordability exemption

Here’s how: Open “Settings” on your iPhone. Go to “Control Center”. Scroll down and tap on the plus icon you see besides the “NFC Tag Reader” option. You will now see the icon in your “Control Center”. If you have .

Affordability (income-related) exemptions. You can qualify for this exemption if the lowest-priced coverage available to you, through either a Marketplace or job-based plan, would cost more than 7.97% of your household income. Get the application form and instructions. How long do .An exemption that’s needed when applying for Catastrophic coverage for people 30 .To fill out a health coverage exemption application, you’ll need to download it .

The amount you pay for covered health care services before your insurance plan . For example, a 55-year-old couple in Chicago who earns ,000 in 2025 would .Affordability (income-related) exemptions. You can qualify for this exemption if the lowest-priced coverage available to you, through either a Marketplace or job-based plan, would cost more than 7.97% of your household income. Get the application form and instructions. How long do affordability exemptions last? For example, a 55-year-old couple in Chicago who earns ,000 in 2025 would receive a subsidy worth about 8 per month, bringing the cost of a mid-level silver plan to 2 per month, down from .

To fill out a health coverage exemption application, you’ll need to download it onto your computer first. Step 1: Identify the correct form for you. Right-click this exemption application form (PDF, 1.2 MB) link for hardship exemptions, like homelessness, bankruptcy, eviction, or foreclosure.

no health insurance exemptions

Questions and answers on the Premium Tax Credit. These updated questions and answers were released to the public in Fact Sheet 2024-30 PDF, Sept. 19, 2024. The basics: Questions 1-4. Eligibility: Questions 5-10. Affordability of employer coverage for employees and for family members of employees: Questions 11-22.The Affordable Care Act calls for all taxpayers to do at least one of three things: Have qualifying health insurance coverage for each month of the year; Have an exemption from the requirement to have coverage; Make an individual shared responsibility payment .As part of this commitment, Treasury is providing information about the exemptions from the requirement to have health coverage if individuals could not afford coverage or met other conditions, and about how to claim an exemption during tax filing.If you don't have health coverage, you may have to pay a fee. You can get an exemption in certain cases. After you mail an exemption application to the Health Insurance Marketplace®, we’ll review it and determine if you qualify.

This publication covers some of the tax provisions of the Affordable Care Act (ACA). It provides information about the individual shared responsibility and the premium tax credit. A glossary is included to help taxpayers understand some terms related to the health care law.

how to apply for affordability exemption

If you have a household income between 100% and 400% of the federal poverty level (FPL), you may qualify for a premium tax credit, which is a subsidy based on income limits that will reduce the monthly cost of health insurance for you and your family on any plan. What Are Exemptions? Exemptions are qualifying life events that do one of three things: Exempt you from the requirement to have coverage (and thus the requirement to make the Individual Shared Responsibility Payment for not having coverage). Qualify you for a Special Enrollment Period to get Marketplace coverage.

Affordability (income-related) exemptions. You can qualify for this exemption if the lowest-priced coverage available to you, through either a Marketplace or job-based plan, would cost more than 7.97% of your household income. Get the application form and instructions. How long do affordability exemptions last?

For example, a 55-year-old couple in Chicago who earns ,000 in 2025 would receive a subsidy worth about 8 per month, bringing the cost of a mid-level silver plan to 2 per month, down from .To fill out a health coverage exemption application, you’ll need to download it onto your computer first. Step 1: Identify the correct form for you. Right-click this exemption application form (PDF, 1.2 MB) link for hardship exemptions, like homelessness, bankruptcy, eviction, or foreclosure.

Questions and answers on the Premium Tax Credit. These updated questions and answers were released to the public in Fact Sheet 2024-30 PDF, Sept. 19, 2024. The basics: Questions 1-4. Eligibility: Questions 5-10. Affordability of employer coverage for employees and for family members of employees: Questions 11-22.The Affordable Care Act calls for all taxpayers to do at least one of three things: Have qualifying health insurance coverage for each month of the year; Have an exemption from the requirement to have coverage; Make an individual shared responsibility payment .As part of this commitment, Treasury is providing information about the exemptions from the requirement to have health coverage if individuals could not afford coverage or met other conditions, and about how to claim an exemption during tax filing.

smart card enrollment agent certificate

If you don't have health coverage, you may have to pay a fee. You can get an exemption in certain cases. After you mail an exemption application to the Health Insurance Marketplace®, we’ll review it and determine if you qualify.This publication covers some of the tax provisions of the Affordable Care Act (ACA). It provides information about the individual shared responsibility and the premium tax credit. A glossary is included to help taxpayers understand some terms related to the health care law.

If you have a household income between 100% and 400% of the federal poverty level (FPL), you may qualify for a premium tax credit, which is a subsidy based on income limits that will reduce the monthly cost of health insurance for you and your family on any plan.

smart card electronic wallet

UPDATE : Some users are experiencing problems background tag reading (not using an app) with iOS 15.5. We've started a discussion board at : https://seritag..

affordable care act exemptions smart card|how to apply for affordability exemption