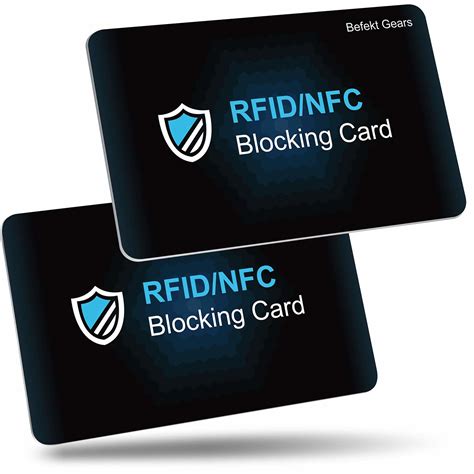

contactless card scames Contactless card payments are fast and convenient, but convenience comes at a price: they are vulnerable to fraud. Some of these vulnerabilities are unique to contactless payment cards, and. For NFC payments to work, someone has to hold their mobile device or tap-to-pay card close to an NFC-enabled reader. The reader then uses NFC technology to search for and identify that payment device. Once it finds .

0 · lloyds contactless card not working

1 · is contactless debit card safe

2 · how to protect contactless card

3 · dangers of contactless cards

4 · contactless payment limit per day

5 · contactless debit card fraud

6 · contactless card not working

7 · bank card contactless not working

Trailing by 24 points late in the third quarter it looked like the 49ers season was over, but then an iconic comeback was engineered by Jeff Garcia!#ClassicG.

lloyds contactless card not working

Contactless card payments are fast and convenient, but convenience comes at a price: they are vulnerable to fraud. Some of these vulnerabilities are unique to contactless payment cards, and.The increasing use of debit and credit cards as well as the introduction of contactless .Top contributors. Cassandra Cross Associate Dean (Learning & Teaching) . Contactless card payments are fast and convenient, but convenience comes at a price: they are vulnerable to fraud. Some of these vulnerabilities are unique to contactless payment cards, and.

We’ll consider the risk posed by contactless card fraud, and how much this developing threat could cost the payments ecosystem. We’ll also look at what actions merchants should take now to address this problem before it grows out of control. The kind of fraud that takes place in the realm of contactless payments, is currently fairly unsophisticated - the accidental loss or deliberate theft of a debit or credit card. Criminals can make several purchases up to the limit before a PIN is needed.Three myths about the dangers of contactless cards. #1 Can someone read my card from a distance? The myth says: Fraudsters would use long-range RFID readers to extract data from contactless cards from a distance and use that card data to access cardholders' accounts and steal money. Reality?

A contactless credit card uses RFID technology to enable you to hover or tap a card over a card terminal as a means of conducting a transaction. The card emits short-range electromagnetic. Credit cards with contactless payment technology can help protect your information by making it harder for hackers to steal. How do I avoid contactless card fraud? Can I opt-out of having a contactless card? Banks routinely issue customers with contactless cards, and 57% of all card transactions were contactless in 2022. Review your account activity regularly to ensure transactions are valid. Report suspicious or fraudulent transactions to your card issuer immediately. Contact your bank or credit union promptly if your card is lost or stolen. If your card is compromised, contact your bank or credit union right away.

Contactless credit cards use radio frequency identification (RFID) to transmit the data, and hackers have been successful in making fake scanners or using card skimmers designed to steal data. Since 2019, all Chase Visa cards have been equipped for contactless payments. American Express and Capital One have also offered contactless cards for some time now. Contactless card payments are fast and convenient, but convenience comes at a price: they are vulnerable to fraud. Some of these vulnerabilities are unique to contactless payment cards, and.

We’ll consider the risk posed by contactless card fraud, and how much this developing threat could cost the payments ecosystem. We’ll also look at what actions merchants should take now to address this problem before it grows out of control. The kind of fraud that takes place in the realm of contactless payments, is currently fairly unsophisticated - the accidental loss or deliberate theft of a debit or credit card. Criminals can make several purchases up to the limit before a PIN is needed.

Three myths about the dangers of contactless cards. #1 Can someone read my card from a distance? The myth says: Fraudsters would use long-range RFID readers to extract data from contactless cards from a distance and use that card data to access cardholders' accounts and steal money. Reality?

A contactless credit card uses RFID technology to enable you to hover or tap a card over a card terminal as a means of conducting a transaction. The card emits short-range electromagnetic.

Credit cards with contactless payment technology can help protect your information by making it harder for hackers to steal.

How do I avoid contactless card fraud? Can I opt-out of having a contactless card? Banks routinely issue customers with contactless cards, and 57% of all card transactions were contactless in 2022. Review your account activity regularly to ensure transactions are valid. Report suspicious or fraudulent transactions to your card issuer immediately. Contact your bank or credit union promptly if your card is lost or stolen. If your card is compromised, contact your bank or credit union right away. Contactless credit cards use radio frequency identification (RFID) to transmit the data, and hackers have been successful in making fake scanners or using card skimmers designed to steal data.

is contactless debit card safe

rfid reader antenna tuning

Basically, an NFC tag is only a physical support, just as a DVD is. It is easy to .

contactless card scames|contactless payment limit per day