gsa smart card tax exempt All GSA SmartPay Purchase cards/accounts are CBAs and should be . How does NFC work? NFC works on top of three crucial innovations in wireless tag readers, cryptographic credit card processing and peer-to-peer connectivity to enable various applications. NFC builds on the work of the RFID set of standards and specifications, such as ISO/IEC 14443 and ISO/IEC 15963.

0 · smartpay 3 card tax exemption

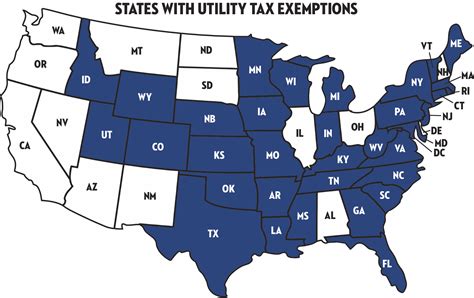

1 · gsa tax exemption map

2 · gsa tax exemption form

3 · gsa tax exempt states map

4 · gsa tax exempt states form

5 · gsa state tax exemption website

6 · gsa smartpay tax exempt form

7 · gsa smartpay state tax information

China MIFARE Card wholesale - Select 2024 high quality MIFARE Card .

State tax exemptions provided to GSA SmartPay card/account holders vary by state. The information displayed is based on the available information from the state taxation authority about sales tax and does not include other taxes assessed by county or local governments.Combines IBA and CBA transactions to provide tax exemption at the point of .All GSA SmartPay Purchase cards/accounts are CBAs and should be .

Tax exemption considerations. All GSA SmartPay CBAs should be exempt from .

Check the tax-exempt status and policies of U.S. states and territories. Go to tax .How do I know which card/account type is exempt from taxes? A hotel indicates .Check the tax-exempt status and policies of U.S. states and territories. Go to tax information. Contract Payments to Vendors. Learn about the advantages of using a GSA SmartPay .

State tax exemptions provided to GSA SmartPay card/account holders vary by state. The information displayed is based on the available information from the state taxation authority about sales tax and does not include other taxes assessed by county or local governments.Check the tax-exempt status and policies of U.S. states and territories. Go to tax information. Contract Payments to Vendors. Learn about the advantages of using a GSA SmartPay Purchase card/account to make contract payments to vendors. Go to the Contract Payments video. Business Lines. Learn more about business lines. Purchase. Combines IBA and CBA transactions to provide tax exemption at the point of sale for rental car and lodging expenses. Charges for rental cars and lodging will be automatically billed to a CBA for payment, taking advantage of the government’s CBA tax exemption status for those types of accounts. You can find out if the state where you are traveling is tax exempt on the Per Diem screen in the Defense Travel System (DTS). When making a reservation, just look for a notification under each TDY location and follow the link to GSA Smartpay for any required Tax Exempt Forms prior to your trip.

All GSA SmartPay Purchase cards/accounts are CBAs and should be exempt from state sales tax. The sixth digit identifier used to differentiate travel cards/accounts does not apply to purchase, fleet, or integrated cards/accounts.

smartpay 3 card tax exemption

Tax exemption and liability differ depending on the card/account type. All GSA SmartPay CBAs should be exempt from state taxes. Federal government travelers using the GSA SmartPay IBAs may be exempt from state taxes in select states.Tax exemption considerations. All GSA SmartPay CBAs should be exempt from state taxes. Federal government travelers using the GSA SmartPay IBAs may be exempt from state taxes in select states. Card/account holders should review and understand the state tax policy for the state where you will be traveling to and should make sure to have all .

smart card что это

State Tax Exemption. For state tax exemption information by state, please visit GSA SmartPay Tax Information. GSA Tax Advantage Travel Card Guide. Links of Interest. GSA SmartPay Program. Appendix B to Circular No. A-123, A Risk Management Framework for Government Charge Card Programs. Points of Contact. Charge Card Program Manager: The Travel Card App also contains tax exemption information, so travelers will know when their business lodging and rental car costs are exempt from state sales tax and if there any forms that must be filled out.How do I know which card/account type is exempt from taxes? A hotel indicates that a card doesn’t look like the card images on the GSA SmartPay website or images that the state provided. The BIN prefix however, does match.

State tax exemptions provided to GSA SmartPay card/account holders vary by state. The information displayed is based on the available information from the state taxation authority about sales tax and does not include other taxes assessed by county or local governments.Check the tax-exempt status and policies of U.S. states and territories. Go to tax information. Contract Payments to Vendors. Learn about the advantages of using a GSA SmartPay Purchase card/account to make contract payments to vendors. Go to the Contract Payments video. Business Lines. Learn more about business lines. Purchase. Combines IBA and CBA transactions to provide tax exemption at the point of sale for rental car and lodging expenses. Charges for rental cars and lodging will be automatically billed to a CBA for payment, taking advantage of the government’s CBA tax exemption status for those types of accounts.

gsa tax exemption map

You can find out if the state where you are traveling is tax exempt on the Per Diem screen in the Defense Travel System (DTS). When making a reservation, just look for a notification under each TDY location and follow the link to GSA Smartpay for any required Tax Exempt Forms prior to your trip.All GSA SmartPay Purchase cards/accounts are CBAs and should be exempt from state sales tax. The sixth digit identifier used to differentiate travel cards/accounts does not apply to purchase, fleet, or integrated cards/accounts.

Tax exemption and liability differ depending on the card/account type. All GSA SmartPay CBAs should be exempt from state taxes. Federal government travelers using the GSA SmartPay IBAs may be exempt from state taxes in select states.Tax exemption considerations. All GSA SmartPay CBAs should be exempt from state taxes. Federal government travelers using the GSA SmartPay IBAs may be exempt from state taxes in select states. Card/account holders should review and understand the state tax policy for the state where you will be traveling to and should make sure to have all .

State Tax Exemption. For state tax exemption information by state, please visit GSA SmartPay Tax Information. GSA Tax Advantage Travel Card Guide. Links of Interest. GSA SmartPay Program. Appendix B to Circular No. A-123, A Risk Management Framework for Government Charge Card Programs. Points of Contact. Charge Card Program Manager:

The Travel Card App also contains tax exemption information, so travelers will know when their business lodging and rental car costs are exempt from state sales tax and if there any forms that must be filled out.

gsa tax exemption form

smart city laundry card

smart card reader software for windows 10

40/pcs BOTW TOTK amiibo Zelda Tears of the Kingdom NFC Cards Mini/Normal Cards. .

gsa smart card tax exempt|smartpay 3 card tax exemption