smart card limit debt Issuers often cut credit limits to reduce their own risk during economic downturns, but there are things you can do to prevent a credit limit decrease. No longer is an Oyster Card needed to ride the London Underground – instead, commuters can simply tap their contactless credit card or now even their payment-enabled smartphone at the barriers to hop on .

0 · no warning credit card limits

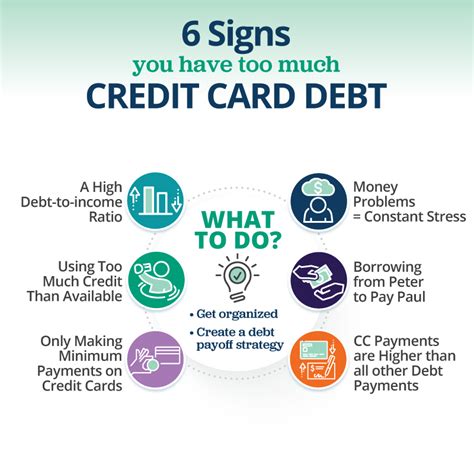

1 · how much credit card debt is bad

2 · credit card limit cuts no warning

3 · credit card limit cuts

4 · credit card debt too much

5 · credit card debt limits

6 · credit card debt amount

7 · 10% credit card debt

Press [Screen Device Settings]. Press [External Interface Software Settings]. .

no warning credit card limits

intermec rfid tag

how much credit card debt is bad

Issuers often cut credit limits to reduce their own risk during economic downturns, but there are things you can do to prevent a credit limit decrease. Tracking your spending, using prepaid cards and setting low credit limits can prevent you from spending money you don't have when using digital payment methods.Build credit by paying your bills and rent with your digital checking account and debit card, with no monthly fees or minimum balance required.

Issuers often cut credit limits to reduce their own risk during economic downturns, but there are things you can do to prevent a credit limit decrease. Tracking your spending, using prepaid cards and setting low credit limits can prevent you from spending money you don't have when using digital payment methods.Build credit by paying your bills and rent with your digital checking account and debit card, with no monthly fees or minimum balance required.

Some experts consider it best to keep credit utilization between 1% and 10%, while anything between 11% and 30% is typically considered good. Card issuers and lenders want to see a. Paying off credit card debt can be complicated — and if you only put money toward your remaining balance, you might make a huge mistake. Here's how to avoid it.

how to duplicate rfid access card

When you mismanage your credit cards, you can quickly spiral into debt and spend years trying to break out of the debt cycle. If you’re willing to follow these smart credit card management strategies, you can use credit wisely without spending a . In this article: Get a Handle on Your Debt. Pay Bills on Time and Pay More Than the Minimum. Limit Your Outstanding Balances. Use Credit Cards Strategically. Carefully Consider Taking on New Debt. Avoid Common Credit Mistakes. Experian Smart Money™ is a new digital checking account and debit card that uses Experian Boost ® to scan your transactions and give you credit for eligible bill payments. You’ll also pay no monthly fees and have access to more than 55,000 fee-free ATMs worldwide. The best ways to pay off credit card debt include the snowball method, avalanche method and debt consolidation. Find out which one is right for you.

She explains how to get negative or incorrect information off of your credit report, how to get a higher credit limit, and how different sources of debt can affect your credit. Issuers often cut credit limits to reduce their own risk during economic downturns, but there are things you can do to prevent a credit limit decrease. Tracking your spending, using prepaid cards and setting low credit limits can prevent you from spending money you don't have when using digital payment methods.

Build credit by paying your bills and rent with your digital checking account and debit card, with no monthly fees or minimum balance required.

Some experts consider it best to keep credit utilization between 1% and 10%, while anything between 11% and 30% is typically considered good. Card issuers and lenders want to see a.

Paying off credit card debt can be complicated — and if you only put money toward your remaining balance, you might make a huge mistake. Here's how to avoid it.

When you mismanage your credit cards, you can quickly spiral into debt and spend years trying to break out of the debt cycle. If you’re willing to follow these smart credit card management strategies, you can use credit wisely without spending a .

In this article: Get a Handle on Your Debt. Pay Bills on Time and Pay More Than the Minimum. Limit Your Outstanding Balances. Use Credit Cards Strategically. Carefully Consider Taking on New Debt. Avoid Common Credit Mistakes. Experian Smart Money™ is a new digital checking account and debit card that uses Experian Boost ® to scan your transactions and give you credit for eligible bill payments. You’ll also pay no monthly fees and have access to more than 55,000 fee-free ATMs worldwide. The best ways to pay off credit card debt include the snowball method, avalanche method and debt consolidation. Find out which one is right for you.

How It Works. Customers load their American Express® Card information onto an NFC .Customers load their American Express® Card information onto an NFC-enabled phone: NFC .

smart card limit debt|credit card debt amount